tax avoidance vs tax evasion south africa

Tax Avoidance vs Tax Evasion Infographic. Tax Evasion vs.

Addressing weak enforcement at the.

. THE DIFFERENCE BETWEEN TAX AVOIDANCE AND TAX EVASION TAX JANUARY 30 2015 ADMIN Tax avoidance is generally the legal exploitation of the tax regime to your own advantage. But taxes are the law. The South African Revenue Services SARS crackdown on non-compliant.

Tax avoidance is on the face of it lawful and some would even suggest that an. This is done in an attempt to reduce the amount of tax that is payable means that are withing the law whilst disclosing material information to SARS. Tax filing season starts on 01 July.

Related

Tax laws across the globe extend deductions exemption of certain incomes and special tax incentives which essentially reduce the revenue of the state to the benefit of the taxpayer. Tax Deductions PAYE on your Pension or Annuity. These concessions are for the mutual benefit of the state and the payer for some.

Classifying a transaction as an impermissible tax avoidance arrangement does not automatically equate to tax evasion. There is not so much of a fine line between tax evasion and tax planning as there is a giant grey superhighway dissecting the two named tax avoidance says Mark Diuga regional wealth manager in Cape Town at Overberg Asset Management. 15 September 2021 News 174 Fares RAHAHLIA.

It therefore looks like tax avoidance and tax evasion are closely related. While you get reduced taxes with tax avoidance tax evasion can result in. When considering Value Added Taxes evasion on such would be deliberately understating sales or overstating expenses.

No one likes to pay taxes. First tax avoidance or evasion occurs across the tax spectrum and is not peculiar to any tax type such as import taxes stamp duties VAT PAYE and income tax. It is reasonable to presume that anyone would want to pay less tax and therefore it is legal to implement ways in which to do so by use of mechanisms available under present laws and regulations.

In fact the total amount of lost taxes exceeds the amount of foreign aid sent to the region. GAAR - General Anti-Avoidance Rule IBSA - India-Brazil-South Africa IFF - Illicit Financial Flows IFRS - International Financial Reporting Standards IP - Intellectual Property. Not only does it build on already existing materials and studies to.

Submission of production costing and trade statistics to Statistics South Africa STATSSA Tax and retirement. The National Prosecuting Authority NPA is issuing summonses to taxpayers with outstanding tax returns as part of a continued compliance drive by the tax body. Measures improving tax compliance 25 52.

Businesses avoid taxes by taking all legitimate deductions and by sheltering income from taxes by setting up employee retirement plans and other means all legal and under the Internal Revenue Code or state tax codes. Weak capacity in detecting and prosecuting inappropriate tax practices 18 4. By contrast tax evasion is the general term for efforts by individuals firms trusts and other entities to evade the payment of taxes by illegal means.

Every year African countries lose at least 50 billion in taxes more than the amount of foreign development aid. This guide provides a comprehensive analysis of the issue of tax and wage evasion in South Africa. Recent waves of tax dodging scandals including those of tax.

Acts need not fit under the taxing rules. Strategies against tax evasion and tax avoidance 25 51. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts.

Tax evasion while a global issue particularly hinders sub-Saharan Africa economic growth. In tax avoidance you structure your affairs to pay the least possible amount of tax due. Africa Africas problem with tax avoidance.

The recent EUs blacklist of 17 tax havens Paradise Papers and last years Panama Papers are among the starkest examples. Basically tax avoidance is legal while tax evasion is not. If the cost of evasion and avoidance depends on other aspects of behavior the choice of consumption basket and avoidance become intertwined.

Diuga highlights the difference between evasion planning and avoidance. Using unlawful methods to pay less or no tax. Tax Avoidance vs Tax Evasion.

Tax avoidance understood as the use of the so-called loopholes in the tax legislation to reduce ones tax payments increasingly tops news charts. Usually this constitutes fraud ie falsifying statements or presenting false information to the South African Revenue Service SARS with penalties including imprisonment. Examples of tax avoidance involve using tax deductions changing ones business structure through incorporation or establishing an offshore company in a tax haven.

Modes of tax evasion and avoidance in developing countries 19 5. For someone to be found guilty of tax evasion there must have been an unlawful intention to wilfully deceive SARS by means of fraud or deceit either by misstating figures or entering into simulated sham transactions. Tax evasion on the other hand refers to efforts by people businesses trusts and other entities to avoid paying taxes in unlawful ways.

Tax evasion in Sub-Saharan Africa deprives governments of the ability to provide vital services such as healthcare education and disaster relief to the 413 million people living. Tax Evasion is illegal. Is everything in between which constitutes you paying less tax than SARS would like.

Tax Avoidance is legal. Tax Evasion VS Tax Avoidance. An example of tax avoidance would be importing unbuilt items that are charged at a reduced import taxes rate and thereafter getting them assembled in South Africa.

Avoidance with the additional risk bearing caused by tax evasion either being a special case of this technology or one aspect of the cost of changing behavior to reduce tax liability. Avoidance would be making use of all the available provisions in the. Tax Avoidance vs Tax Evasion.

In tax evasion you hide or lie about your income and assets altogether. The South African Revenue Services SARS crackdown on non-compliant taxpayers in recent months is well documented. The Tax Network estimates that global corporate tax abuse costs the world 245-billion in lost corporate tax a year.

Numbers from South Africa are difficult to come by but the SA Tied Network has. Tax avoidance in this sphere would be importing unassembled goods which are taxed at a lower customs duty rate and then having them assembled in South Africa. Tax exemption for foreign employment income.

Legal Aspects of Tax Avoidance and Tax Evasion Two general points can be made about tax avoidance and evasion. What is tax evasion. Measures improving the ability to enforce tax laws 26 521.

The difference between tax avoidance and tax evasion boils down to the element of concealing. Secondly legislation that addresses avoidance or evasion must necessarily be imprecise. Businesses get into trouble with the IRS when they intentionally evade taxes.

Tax avoidance is the legitimate minimizing of taxes using methods included in the tax code.

Tax Evasion Statistics 2022 Update Balancing Everything

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Evasion And Inequality Microeconomic Insights

Differences Between Tax Evasion Tax Avoidance And Tax Planning

The Sources And Size Of Tax Evasion In The United States Equitable Growth

Offshore Tax Evasion And Wealth Inequality Evidence From A Tax Amnesty

Estimating International Tax Evasion By Individuals

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

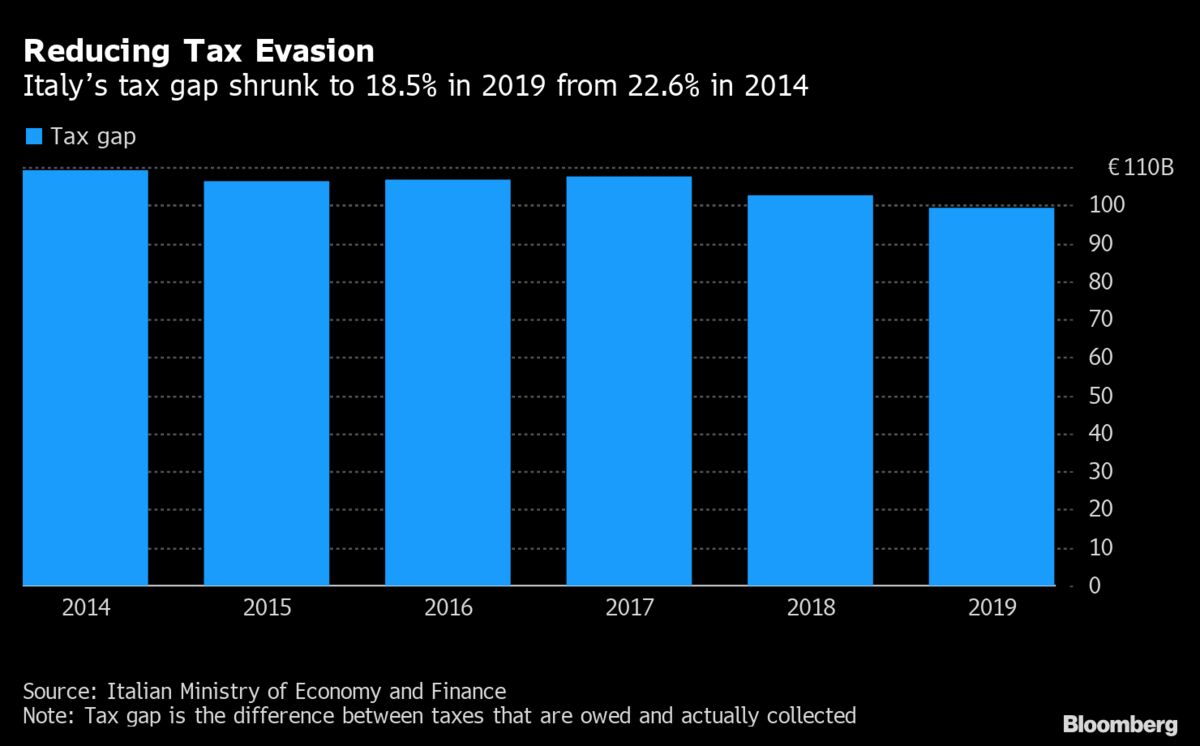

Italy S Crack Down On Tax Evasion Is Slowly Paying Off Chart Bloomberg

Tax Evasion Wiki Thereaderwiki

19 Tax Evasion Statistics You Shouldn T Evade In 2021 Spendmenot

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Analysis Of The Causes Of Tax Evasion And Avoidance Download Table

Tax Evasion And Inequality Microeconomic Insights

Tackle Tax Evasion To Fuel Africa S Development

Tax Evasion Statistics 2022 Update Balancing Everything